Renters Insurance in and around Chicago

Chicago renters, State Farm has insurance for you, too

Coverage for what's yours, in your rented home

Would you like to create a personalized renters quote?

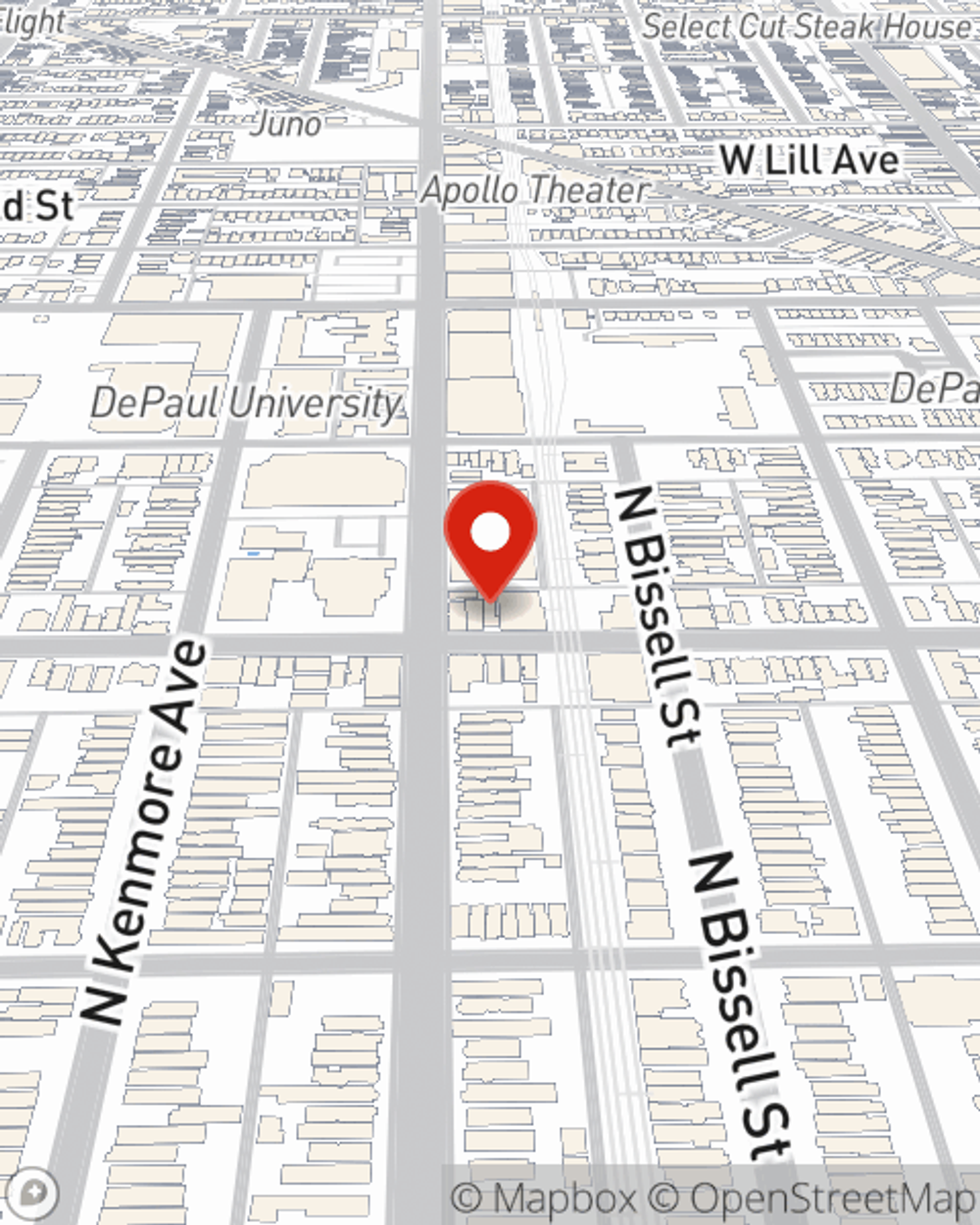

- Lincoln Park

- DePaul

- Lakeview

- Gold Coast

- Andersonville

- Wrigleyville

- Lincoln Yards

- River North

- Bucktown

- City Centre

- Wicker Park

- Southport Corridor

- Streeterville

Calling All Chicago Renters!

No matter what you're considering as you rent a home - internet access, number of bathrooms, price, apartment or house - getting the right insurance can be necessary in the event of the unexpected.

Chicago renters, State Farm has insurance for you, too

Coverage for what's yours, in your rented home

State Farm Has Options For Your Renters Insurance Needs

No one knows what tomorrow will bring. That’s why it makes good sense to plan for the unexpected with a State Farm renters policy. Renters insurance protects your precious belongings with coverage. If you experience a break-in or a theft, some of your belongings might have damage. Without adequate coverage, you might not be able to replace your valuables. It's scary to think that in one moment, you could risk losing all your possessions. Despite all that could go wrong, State Farm Agent Linda Kuczka is ready to help.Linda Kuczka can help offer options for the level of coverage you have in mind. You can even include protection for valuables when they are outside of your home. For example, if your car is stolen with your computer inside it, your bicycle is stolen from work or a pipe suddenly bursts in the unit above you and damages your furniture, Agent Linda Kuczka can be there to help you submit your claim and help your life go right again.

Reach out to State Farm Agent Linda Kuczka today to check out how a State Farm policy can protect your possessions here in Chicago, IL.

Have More Questions About Renters Insurance?

Call Linda at (773) 975-9111 or visit our FAQ page.

Simple Insights®

Should you DIY your move or hire someone?

Should you DIY your move or hire someone?

Moves can vary in price — and effort. We walk you through your options, from DIY to full-service professional movers, and provide recommendations for when to opt for each.

Linda Kuczka

State Farm® Insurance AgentSimple Insights®

Should you DIY your move or hire someone?

Should you DIY your move or hire someone?

Moves can vary in price — and effort. We walk you through your options, from DIY to full-service professional movers, and provide recommendations for when to opt for each.